The CEO’s Missing Advisor: Cyber Risk at the Table

Cyber is now the number-one business risk, but most CEOs still do not have a Cyber Risk Advisor in their inner circle.

When I was a kid, I wanted to be Batman. Not because of the gadgets or the car (though the Batmobile was pretty cool), but because Batman was the one who defended the city when others couldn’t. He saw the threats others missed. He operated in the shadows. He didn’t wait for permission. He simply protected what mattered.

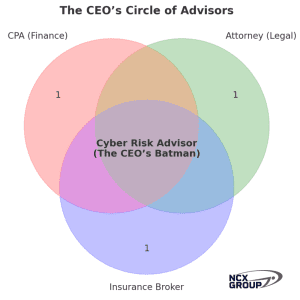

Fast forward to today, and that is what being a Cyber Risk Advisor feels like. CEOs have their circle of advisors: CPAs, attorneys, insurance brokers. But when it comes to defending against the top business risk today, cyber, the seat at the table is still empty.

The Allianz Risk Barometer 2025 found that 38 percent of corporate risk professionals rank cyber incidents such as ransomware, data breaches, and outages as their number-one concern. This ranks higher than natural catastrophes or traditional business interruption. And while studies vary, many reports suggest that as many as 60 percent of small businesses shut down within six months of a major cyber event. Whether the precise figure is 60 percent or not, the lesson is clear: too many companies simply do not survive the financial, reputational, and operational hit.

A Little History of “Damn, I Need an Advisor”

It wasn’t always the norm for CEOs to surround themselves with advisors. Each role became essential only after painful lessons.

CPAs (early 1900s): When the U.S. introduced income tax in 1913, business owners suddenly had the IRS breathing down their necks. That is when CEOs said: “Damn, I need a CPA.”

Attorneys (mid-1900s): As contracts grew more complex and lawsuits more costly, CEOs learned the hard way that a handshake deal would not cut it. After one expensive courtroom battle, they said: “Damn, I need an attorney.”

Insurance Brokers (post-WWII): As businesses expanded, a fire, accident, or flood could wipe out everything. After watching peers lose their companies overnight, CEOs said: “Damn, I need an insurance broker.”

Those “Damn, I need one” moments turned optional advisors into mandatory allies.

The Missing Seat Today: Cyber Risk

Cyber is now the number-one business risk, but most CEOs still do not have a Cyber Risk Advisor in their inner circle.

A true Cyber Risk Advisor is the only advisor who spans all three domains:

Law – breach disclosure, privacy regulations, compliance requirements.

Finance – downtime costs, valuation hits, rising insurance premiums.

Technology – validating MSPs, hardening systems, closing real-world gaps.

Cyber Risk Advisors do not replace your CPA, attorney, or broker. They strengthen them, ensuring their advice holds up under today’s most common threat: cyber risk.

That is why the Cyber Risk Advisor belongs at the center of the CEO’s circle of advisors.

Unlike the CPA, attorney, or broker whose work ultimately aligns with regulators, courts, or carriers, the Cyber Risk Advisor’s loyalty is to the business itself.

That is why I go back to Batman. Batman wasn’t there for the politicians or the insurers. He was there for Gotham.

In the same way, the Cyber Risk Advisor is there for the CEO. We are the CEO’s Batman, the one advisor whose mission is to defend the business itself.

What Will Make This the Norm

It will not be regulators. It will not be insurance companies.

It will be peer adoption.

CEOs will add Cyber Risk Advisors to their circle when they see other CEOs doing it, not because they are told to, but because it is the smart, innovative move.

The innovators will move first. The rest will follow.

The only question is:

Will you be ahead of the curve, or will you wait for your own “Damn, I need a Cyber Risk Advisor” moment?

If you’d like to explore how NCX Group helps businesses prepare for a successful sale or acquisition by addressing cyber risk head-on, visit us at www.ncxgroup.com. And if this article resonated with you, please like it and share it with someone you know who may be thinking about selling their business—because the right advisor at the right time can make all the difference.

Mike Fitzpatrick Founder and CEO, NCX Group

P.S. Every CEO already has their Commissioner Gordon and Harvey Dent. What they don’t have is their Batman.

Repost from LinkedIn – https://www.linkedin.com/pulse/ceos-missing-advisor-cyber-risk-table-mike-fitzpatrick-wzzee/

Let’s Talk

If it’s been more than a year since your last cybersecurity assessment—or if you’ve never done one—now is the time.